(This is a sponsored story written by John Madrid, Managing Broker with John L. Scott Real Estate.)

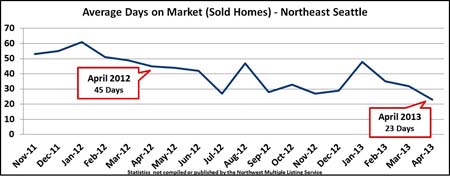

There are no signs that the current trends of low inventory, rising prices, short sales times and multiple offers will be abating anytime soon.

For Northeast Seattle, including Maple Leaf, Bryant, Laurelhurst, University, View Ridge and Wedgwood, there continues to be only about a one-month supply of single-family home inventory. This tight inventory can be attributed to continued low interest rates, robust Puget Sound area hiring and a generally improved economy including significant gains in the stock market. Whether the market will become more “balanced” (defined as a 3-6 month supply of homes) will hinge on many more listings hitting the market over the coming months.

Of homes closed in Northeast Seattle in April the average sale price was a little over 102% of the most recent list price. This indicates continued multiple offer situations.

Prospective buyers also should think in terms of at least a minimum of 3-5+ year home ownership horizon and preferably maintain the option to hold onto their home through future downturns in the market. Home seller costs (excise tax, title/escrow fees, sale commissions) of approximately 9% of the sales price should also be factored into any decision to purchase.

More stats on other Seattle neighborhoods can be found at

http://www.live206.com/seattle-market-update-c22527.html

John Madrid is a managing broker with John L. Scott Real Estate – University Village and is a 2005-2012 Seattle Magazine “Five Star” Agent. His clients include both home buyers and sellers. He can be reached at 206-498-1880, john@live206.com or www.live206.com.

Statistics are deemed reliable but are not guaranteed. All information should be verified to the users own satisfaction.

The advise I give folks that I have been working with that are move up buyers is as follows:

1) simultaneous close with the same lender, title & escrow. Use proceeds of home sale as part of downpayment on new home. –This can be a little difficult if the buyer of your home is using a small internet broker so pick a buyer

2) setup the sale of the 1st home with a rentback option in contract from new buyers. Closing in the middle of the month allows 2 weeks until the end of the month in which all parties should have time to move and get closings done

3)A few lenders are doing bridge loans.

4) setup closing as 45 days or sooner

5) The number 1 delay in closing is moving money around and large deposits that are outside of the norm. Get it moved 60 days prior to be safe.

6) a lender like HomeStreet with local fulfillment

Good news for “estimated” home values. The problem is most people can’t sell because there is so limited inventory and loan losing times are all over the map making the scheduling of a sale and purchase very difficult. What family wants to risk listing their house and having it sell really fast then being stuck without a home to buy or waiting for a ridiculous long closing cycle.